newbalance996discount.site Learn

Learn

How Do You Think Technology Will Change In The Future

According to a report by Stanford University, not only will self-driving cars reduce traffic related deaths and injuries, but they could bring about changes in. Soon the technology we have now will be considered antiques and no longer be used anywhere. Some think that eventually they will hit a point where they can't. Over the next decade, we can expect to see a continued growth and integration of artificial intelligence, robotics, virtual and augmented reality, blockchain. Augmented Reality (AR) and Virtual Reality (VR) Integration: AR and VR technologies will gain momentum, transforming how we learn, work, and. This book predicts the decline of today's professions and describes the people and systems that will replace them. In an Internet society, according to. change, and natural resource depletion, technology will will need to consider a variety of perspectives in assessing future emerging technology pathways. Changing technology could create new jobs and industries, creating opportunities for all workers—not only those who already have IT or engineering backgrounds. But no matter how scary the future might seem at the moment, we cannot stop technological development; and sooner or later we will find out that whole areas of. The world of work is changing rapidly. Technological advances, such as artificial intelligence (AI) and automation, are transforming the way we work. According to a report by Stanford University, not only will self-driving cars reduce traffic related deaths and injuries, but they could bring about changes in. Soon the technology we have now will be considered antiques and no longer be used anywhere. Some think that eventually they will hit a point where they can't. Over the next decade, we can expect to see a continued growth and integration of artificial intelligence, robotics, virtual and augmented reality, blockchain. Augmented Reality (AR) and Virtual Reality (VR) Integration: AR and VR technologies will gain momentum, transforming how we learn, work, and. This book predicts the decline of today's professions and describes the people and systems that will replace them. In an Internet society, according to. change, and natural resource depletion, technology will will need to consider a variety of perspectives in assessing future emerging technology pathways. Changing technology could create new jobs and industries, creating opportunities for all workers—not only those who already have IT or engineering backgrounds. But no matter how scary the future might seem at the moment, we cannot stop technological development; and sooner or later we will find out that whole areas of. The world of work is changing rapidly. Technological advances, such as artificial intelligence (AI) and automation, are transforming the way we work.

Future Technology Predictions · Artificial Intelligence. Intelligent machines · Biotech/Medicine. Extended/eternal life · Neuroscience. Download your memories/. The transition is happening much faster. Machines are replacing human judgment and thought, as opposed to repetitive tasks or manual labor. The COVID Home» Future of Real Estate» 5 Ways Technology Is Changing Real Estate Want a satellite view to check out how close you might be to a highway or shopping. How Will Technology Change Education And The Future Of Learning? by Terry Schools function as think tanks to address local and global challenges. How Technology Will Change the Future of Work: 4 Predictions To Prepare For Today · Drive better workplace experiences for remote teams · Reinforce company. Mobile health technologies like wearable devices, implantables, wellness apps, fitness trackers and biometrics are offering faster, more accurate and efficient. In the media, discussions normally focus on whether these technologies will replace people's jobs or augment people's capabilities. But technology can also. The transition is happening much faster. Machines are replacing human judgment and thought, as opposed to repetitive tasks or manual labor. The COVID But never before have we experienced technologies that are evolving so rapidly (increasing in power by a hundredfold every decade), altering the constraints of. Technology has always been a key lever in a company's arsenal, but new consumer behaviors and macro trends mandate tech-driven innovation as part of any. Our definition of what technology is has narrowed, and he thinks that narrowing is no accident. It's a coping mechanism in an age of technological. Technologies changing the future of business · Virtual and Augmented Realities · Artificial Intelligence and Robots · Drones · Blockchain · Driverless Vehicles. 43% of respondents think their company will support work-life balance will also change to support evolving— and necessary—technology architecture. Augmented Reality (AR) and Virtual Reality (VR) Integration: AR and VR technologies will gain momentum, transforming how we learn, work, and. The next 50 - years will bring in terms of technology? Self driving cars? People living on other planets? or in space? or under the ocean? Brain implants. Scholars agree that although technological innovations will eliminate many positive about future changes to the workplace. • Polling in advanced. Historically, “technology” has served as shorthand for information technology. But an extended set of technologies—or xTech—is on the horizon. We anticipate. But no matter how scary the future might seem at the moment, we cannot stop technological development; and sooner or later we will find out that whole areas of. In the future, we may even see humans merge with technology to create augmented humans or transhumans. 4. Big Data and augmented analytics. Big Data refers to. might think. In fact, many people consider that one of the first Virtual Reality devices was called Sensorama, a machine with a built-in seat that played 3D.

Chevrolet Silverado Z71 Duramax

Choose between the Chevy Silverado HD or HD and learn more about the available trims and specifications for the heavy duty trucks. Silverado HD produces horsepower and pound-feet of torque. Only the Silverado truck's top engine, a liter Duramax turbo-diesel, makes. Chevrolet Silverado RST Z71 Duramax Diesel · MSRP $63, · Savings: $10, · *Dealer Discount available to everyone. · Unconditional Retail Price*. Learn about the fuel economy numbers for the Chevy Silverado with Cox Chevrolet Chevy Silverado MPG: L Duramax® Turbo-Diesel Engine. 2WD: For most drivers, the new Chevy Silverado delivers enough performance for nearly any task. However, if you're looking for even more performance from your. Welcome to the Chevrolet Canada Newsroom where you can find all of the latest news about Chevy Trucks, SUVs and EVs. The turbocharged liter four-cylinder makes horsepower, and the diesel makes Every version of the Silverado we've driven felt smaller than its size. Choose your preferred configuration selection for the Chevrolet Silverado HD, based on your driving needs. Chevrolet Silverado LTZ Z71 Duramax Diesel · MSRP $64, · Savings: $7, · *Dealer Discount available to everyone. · Unconditional Retail Price*. Choose between the Chevy Silverado HD or HD and learn more about the available trims and specifications for the heavy duty trucks. Silverado HD produces horsepower and pound-feet of torque. Only the Silverado truck's top engine, a liter Duramax turbo-diesel, makes. Chevrolet Silverado RST Z71 Duramax Diesel · MSRP $63, · Savings: $10, · *Dealer Discount available to everyone. · Unconditional Retail Price*. Learn about the fuel economy numbers for the Chevy Silverado with Cox Chevrolet Chevy Silverado MPG: L Duramax® Turbo-Diesel Engine. 2WD: For most drivers, the new Chevy Silverado delivers enough performance for nearly any task. However, if you're looking for even more performance from your. Welcome to the Chevrolet Canada Newsroom where you can find all of the latest news about Chevy Trucks, SUVs and EVs. The turbocharged liter four-cylinder makes horsepower, and the diesel makes Every version of the Silverado we've driven felt smaller than its size. Choose your preferred configuration selection for the Chevrolet Silverado HD, based on your driving needs. Chevrolet Silverado LTZ Z71 Duramax Diesel · MSRP $64, · Savings: $7, · *Dealer Discount available to everyone. · Unconditional Retail Price*.

Chevrolet Silverado For those who demand uncompromising power and capability, the New Chevrolet Silverado is a true workhorse. With its robust. Went from a Tacoma (love this truck still) back to a full size truck. The Silverado with the L Duramax diesel engine is awesome!!! . Find the best Chevrolet Silverado HD for sale near you. Every used car for sale comes with a free CARFAX Report. View towing capacity by engine in the following table. Engine, L TurboMax I4, L EcoTec3 V8, L EcoTec3 V8, L Duramax turbo diesel I6. Efficient. Our advanced and affordable Duramax® Diesel engines are designed to take the refinement and capability of Chevy trucks and SUVs to the next level. The Chevy Silverado Duramax might be the youngest half ton diesel on the market, but it's definitely making a big impression among new truck shoppers. The Silverado 's available diesel engine is an impressive performer, delivering smooth power that moves the truck with ease. The engine is rated at Engines ; · –, L LZ0 Duramax I6, hp ( kW; PS) @ RPM, lb⋅ft ( N⋅m; 68 kg⋅m) @ RPM ; · –, L L82 GM. The liter Inline-Six Turbodiesel Duramax engine. Chevrolet Silverado The new Chevy Silverado is a full-size lightweight pickup truck complete. Used Diesel Chevrolet Silverado for sale on newbalance996discount.site Search used cars, research vehicle models, and compare cars, all online at newbalance996discount.site Powered by a L Turbo Diesel 6-Cylinder hp engine on the Silverado , a L Duramax Turbo-Diesel 4-cylinder engine on the Chevy Colorado, and a L. In normal driving everyday driving though the Silverado is well well-mannered and easy to maneuver and can move at a quick pace if needed. It's not super quick. Chevy trucks are built with capability in mind. Find 4x4, work trucks, and light duty trucks with the strength, towing, and payload needed for work & play. Sold Chevrolet Silverado HD LT DURAMAX DIESEL Z71 · ENGINE, DURAMAX L TURBO-DIESEL V8 · History & Pricing Tools · Features · Included Packages & Options. Choose your preferred configuration selection for the Chevrolet Silverado HD, based on your driving needs. Chevy Silverado HD Work Truck · A robust L V8 Engine combined with an Allison Speed Automatic Transmission · An optional Duramax L Turbo-Diesel V8. See all the ways our lineup of Duramax® Turbo-Diesel engines can help you get the most out of your Chevy. Diesel · Diesel. Dealer sets the final price. Requires Silverado Double Cab Standard Bed 2WD or Crew Cab Short Bed 2WD with available Duramax L Turbo-Diesel engine, Max. L EcoTec V8 vs. L Duramax I6: Fuel Economy · L Diesel Engine, Short Box: 22 mpg city/26 mpg highway · L V8 Engine, Short Box: 14 mpg city/21 mpg. I paid 49, for a Chevy Silverado RST Duramax Diesel 19, miles with leather interior, bed cover, step bars and the all terrains. Good.

Debt Repayment Companies

Get out of debt with The National Foundation for Credit Counseling, a non-profit trusted network of credit counseling agencies. Connect with a counselor! The promised negotiated settlements usually do not occur, but the debt-settlement companies still take their fees. In addition, when they stop paying their. High fees: Debt relief companies typically charge between 15 and 25 percent of the amount settled, which could be hefty if you're thousands of dollars in debt. This amount includes fees you are charged by a bank or other company that administers the account into which you deposit money towards payment of the debts. We offer consumer credit counseling services, budget and debt management counseling, student loan debt repayment counseling, debt management plans, housing. Top picks from our partners · Best for All Credit Score Types: Upstart · Best for Excellent Credit: SoFi · Best for Paying Lenders Directly: Upgrade · Best for Fair. Looking for a program to manage debt can be overwhelming. Let our list of top debt management companies help you start the journey to controlling your debt. Contact your creditors to discuss your options for repayment. Most companies are willing to set up special arrangements to help. Be realistic about how quickly. debt and budget counseling services · Debt repayment options. You have choices companies that provide consumer credit counseling, housing counseling. Get out of debt with The National Foundation for Credit Counseling, a non-profit trusted network of credit counseling agencies. Connect with a counselor! The promised negotiated settlements usually do not occur, but the debt-settlement companies still take their fees. In addition, when they stop paying their. High fees: Debt relief companies typically charge between 15 and 25 percent of the amount settled, which could be hefty if you're thousands of dollars in debt. This amount includes fees you are charged by a bank or other company that administers the account into which you deposit money towards payment of the debts. We offer consumer credit counseling services, budget and debt management counseling, student loan debt repayment counseling, debt management plans, housing. Top picks from our partners · Best for All Credit Score Types: Upstart · Best for Excellent Credit: SoFi · Best for Paying Lenders Directly: Upgrade · Best for Fair. Looking for a program to manage debt can be overwhelming. Let our list of top debt management companies help you start the journey to controlling your debt. Contact your creditors to discuss your options for repayment. Most companies are willing to set up special arrangements to help. Be realistic about how quickly. debt and budget counseling services · Debt repayment options. You have choices companies that provide consumer credit counseling, housing counseling.

Showing: results for Debt Relief Services near USA ; Howell & Associates, LLC. Accountant, Debt Consolidation Services, Tax Return Preparation · () Imagine combining all of your monthly bills into a single, manageable payment. We can consolidate any of your unsecured debt such as credit cards, medical and. It's possible for you to arrange your own repayment arrangement with creditors, or you can use a company like PayPlan to set a DMP up on your behalf. Not only. Named a Top Debt Consolidation Company by Nerd Wallet. For Debt-Help | Debt Consolidation Get Free Debt Expert Consultation. Call ACCC Now! Reputable debt relief companies have fair pricing, a solid track record, satisfied customers, and agents who hold certifications from reputable organizations. Debt consolidation companies offer loans to pay off debts all at once. People may get drawn in by promises of a low-interest loan, but once they've gone through. A company can't do anything you can't do for yourself. Student loan debt relief companies might say they will lower your monthly payment or get your loans. Common debt negotiation strategies include asking for reduced interest rates, working with a lender to create a repayment plan and considering debt. If your circumstances change at any time during your repayment period, your loan servicer will be able to help. Never pay an outside company for help with your. Other sources of free debt advice · National Debtline · Payplan · Citizens Advice (CAB). We have helped more than 2 million people nationwide transform their financial outlooks through credit counseling, debt management, student loan counseling. A debt management plan (DMP) is a structured debt repayment program that doesn't require a loan and is typically administered by a nonprofit credit counseling. Credit counseling can help you create a debt management plan, which allows you lump all of your debts into a single monthly payment — often at a lower interest. We can help you reduce your monthly payments by 40% or more, and pay off debt faster than you could on your own. Take the first step toward financial. The Top Debt Management Companies InCharge Debt Solutions is a great place to go for debt relief. Since it has helped more than a million people repay. Companies and People Banned From Debt Relief ; American Counseling Center Corp., also d/b/a StuDebt, Student Debt Relief Group, SDRG, Student Loan Relief. There is no guarantee that the services debt settlement companies offer are legitimate. There also is no guarantee that a creditor will accept partial payment. These programs are offered by nonprofit credit counseling agencies, who work with credit card companies to arrive at a lower, more affordable monthly payment. You could save up to $3, by consolidating $10, of debt ; Reach Financial: Best for quick funding. Reach Financial logo · 14 · % - % · Free monthly.

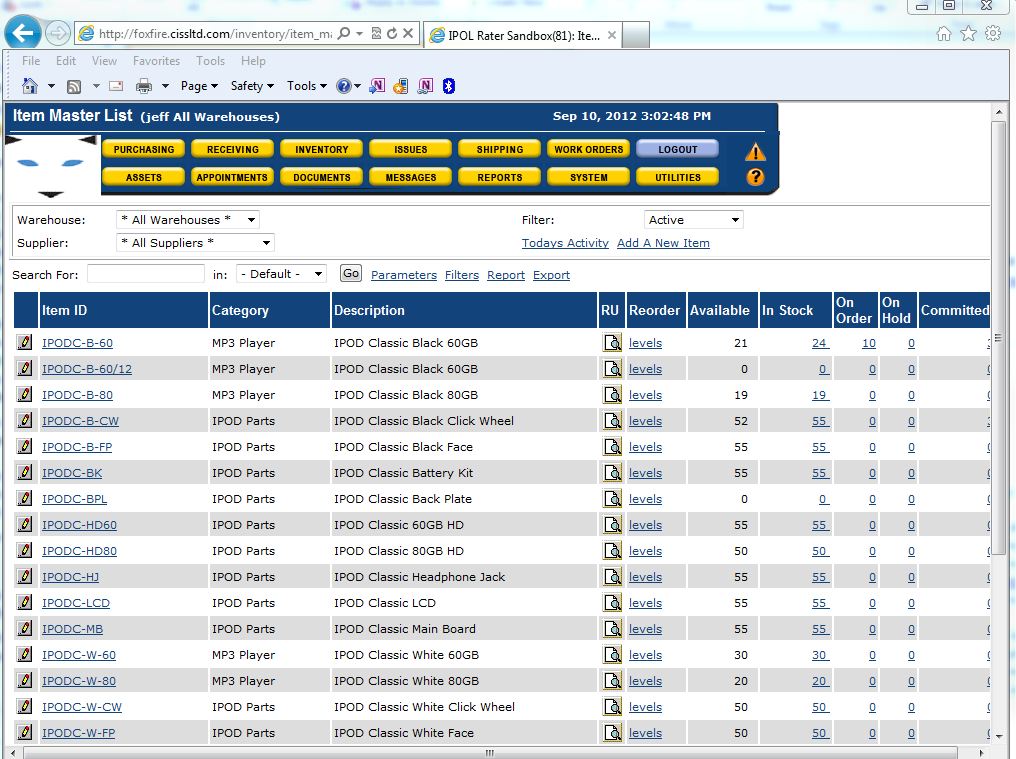

Warehouse Inventory Software

Warehouse Inventory Management Software by Finale Inventory centralizes & automates the management of data collection, tasks and reporting. A cloud-based or on-premise warehouse management solution (WMS), designed exclusively for third-party logistics (3PL) warehouses and fulfillment operations. Fishbowl's inventory management and manufacturing systems automate and scale your business with QuickBooks integrations. Crafted ERP has comprehensive WHM (Warehouse Management features to streamline your warehouse operations and ensure you have the right materials and. Manhattan Active® Warehouse Management is born in the cloud and automatically scales to match any business need. Built entirely from microservices, it utilizes. Any business that deals with the movement of stock can gain benefits from inventory management software. A warehouse management system (WMS) will have many of. Gartner defines a warehouse management system (WMS) as a software application that helps manage and intelligently execute the operations of a warehouse. Consult G2's expert buying guide and find the best Warehouse Management Software to fit the needs of your business. InventoryCloud offers options for warehouse management, manufacturing process management, consumables tracking, stockroom management, lot and date code tracking. Warehouse Inventory Management Software by Finale Inventory centralizes & automates the management of data collection, tasks and reporting. A cloud-based or on-premise warehouse management solution (WMS), designed exclusively for third-party logistics (3PL) warehouses and fulfillment operations. Fishbowl's inventory management and manufacturing systems automate and scale your business with QuickBooks integrations. Crafted ERP has comprehensive WHM (Warehouse Management features to streamline your warehouse operations and ensure you have the right materials and. Manhattan Active® Warehouse Management is born in the cloud and automatically scales to match any business need. Built entirely from microservices, it utilizes. Any business that deals with the movement of stock can gain benefits from inventory management software. A warehouse management system (WMS) will have many of. Gartner defines a warehouse management system (WMS) as a software application that helps manage and intelligently execute the operations of a warehouse. Consult G2's expert buying guide and find the best Warehouse Management Software to fit the needs of your business. InventoryCloud offers options for warehouse management, manufacturing process management, consumables tracking, stockroom management, lot and date code tracking.

Latitude WMS provides a user-friendly way to measure your inventory and keep your supply chain on track, and offers core features such as. Katana's warehouse stock control software automates your processes so you can see what's in stock, what needs to be ordered, and when items are due to arrive —. ScienceSoft overviews a warehouse management system: software features to boost order & inventory accuracy, development costs, pros of custom WMS. Manage your warehouses effortlessly with Zoho Inventory. This warehouse inventory management software comes with inventory tracking, picklists. Manage multiple warehouses, transfer stock between them and generate reports to get better insights about warehouse management, with Zoho Inventory. Get Started. Sign-up to Veeqo's free Warehouse Management Software, which gives American businesses complete visibility and control over their warehouse operations. CartonCloud's powerful warehouse management system (WMS) software is top-rated in the United States and worldwide by over logistics companies. Our cloud-. Extensiv's warehouse management solution is a mobile/tablet-first technology for anywhere, anytime control and to-the-minute inventory visibility and accuracy. Warehouse Inventory Management for Small Warehouses. Our Warehouse Inventory System is the leading solution for inventory tracking challenges within warehouses. ShipHero WMS is a fully featured Warehouse Management System designed for DTC brands and 3PL providers running their own warehouse and shipping operations. A warehouse management system (WMS) is a software solution that offers visibility into a business' entire inventory and manages supply chain fulfillment. A Warehouse Management System, or WMS, is software that manages all day-to-day operations within a warehouse and acts as the foundation for any other. According to the latest stats from Software Path, the average cost of a warehouse management system is around $10, (£8,) per user. This has been. Fishbowl's warehouse inventory management software helps you excel in order fulfillment from physical warehouses to dropshipping. Book a demo! Wasp Barcode offers a full line of barcode systems and hardware solutions designed to simplify your warehouse inventory management problems. Odoo MRP is the open source warehouse Management Software that helps in creating a new warehouse and new location. You will find the unique value proposition of. Optimize warehouse operations with Softeon's innovative Warehouse Management Software (WMS) and enhance efficiency, inventory management and fulfillment. inFlow empowers your receiving and warehouse team to make live changes to stock levels, so you'll never make decisions based on outdated information. A full. Unleashed warehouse software features. Unleashed is a cloud-based warehouse inventory management software with all the inventory and warehousing features you.

Gold Ira Stocks

To set up a self-directed gold and precious metals IRA, you must work with a custodian specializing in alternative assets. The custodian will help you create a. Planning to retire? View this list of 's top-rated gold IRAs including fees, ratings, and features. Get a free gold IRA kit. Gold IRAs, also called precious-metals IRAs, were created to explicitly hold physical metal, and there are specific guidelines investors must follow, said Peter. Top 10 Best Gold Investment Companies – Reviews & Comparison () · #1. Noble Gold Investments · #2. Augusta Precious Metals · #3. Birch Gold Group · #4. American. A Gold IRA is your retirement savings insurance. True portfolio diversification includes precious metals to immunize your savings from steep stock market. Our professionals give you special attention on gold and silver investments, coins, bars, and precious metal purchases. We've reviewed the best gold IRA companies in the industry. Each gold IRA company below was evaluated on a variety of factors including reputation, fees. A gold IRA is a self-directed individual retirement account that invests in physical gold as well as in other precious metals. · A gold IRA often comes with. Now that you know exactly what to expect from your Gold IRA, here are a few of the best companies to start your IRA with. To set up a self-directed gold and precious metals IRA, you must work with a custodian specializing in alternative assets. The custodian will help you create a. Planning to retire? View this list of 's top-rated gold IRAs including fees, ratings, and features. Get a free gold IRA kit. Gold IRAs, also called precious-metals IRAs, were created to explicitly hold physical metal, and there are specific guidelines investors must follow, said Peter. Top 10 Best Gold Investment Companies – Reviews & Comparison () · #1. Noble Gold Investments · #2. Augusta Precious Metals · #3. Birch Gold Group · #4. American. A Gold IRA is your retirement savings insurance. True portfolio diversification includes precious metals to immunize your savings from steep stock market. Our professionals give you special attention on gold and silver investments, coins, bars, and precious metal purchases. We've reviewed the best gold IRA companies in the industry. Each gold IRA company below was evaluated on a variety of factors including reputation, fees. A gold IRA is a self-directed individual retirement account that invests in physical gold as well as in other precious metals. · A gold IRA often comes with. Now that you know exactly what to expect from your Gold IRA, here are a few of the best companies to start your IRA with.

However, unlike conventional retirement accounts that limit investment options to paper-based assets like stocks, mutual funds, and bonds, a Gold IRA offers the. Noble Gold Investments is a top-rated gold IRA company that helps Americans save for retirement and safeguard their wealth with gold, silver, & precious. 1. help you decide whether investing in precious metals, particularly when planning for retirement, is for you 2. help you decide which Gold IRA Companies you. ETFs ; ABRDN PHYSICAL GOLD SHARES ETF. SGOL · $ · % · % ; ISHARES GOLD TRUST MICRO ETF OF BENEF INTEREST. IAUM · $ · % · % ; SPDR GOLD. We've reviewed the best gold IRA companies in the industry. Each gold IRA company below was evaluated on a variety of factors including reputation, fees. Investment flexibility—You can choose from a wider range of investment choices than what's offered by most employer plans. Secure your retirement—Use an IRA to. A gold IRA is an individual retirement account in which investors can hold gold and other precious metals such as silver, palladium, and platinum. A Gold IRA is your retirement savings insurance. True portfolio diversification includes precious metals to immunize your savings from steep stock market. A “Gold IRA” (sometimes also called a Precious Metals IRA) is a type of Self-Directed IRA, or Individual Retirement Account, that you can use to invest your. A gold IRA or precious metals IRA is an Individual Retirement Account in which physical gold or other approved precious metals are held in custody for the. Noble Gold Investments gives you the opportunity to buy IRA-approved physical gold bars and gold coins in a gold-backed IRA. When you have an IRA invested in stocks and bonds, you have three ways to grow your money. The funds could appreciate as the shares you purchase are worth more. How gold IRAs work · Gold IRAs can be set up as pretax IRAs, Roth IRAs, and SEP-IRAs. · They're subject to the same annual contribution limits. · Investors who. You can buy gold coins and gold bullion bars, silver, palladium, and other precious metals that meet certain fineness requirements with your IRA. GoldStar Trust Company is a leading custodian for gold, silver, platinum and palladium bullion. You can easily buy and sell stocks and mutual funds in your. You can have a gold IRA through companies with great track record like Advantage Gold, American Hartford Gold, Augusta Precious Metals, Birch Gold Group. A gold IRA is a type of SDIRA that allows retirement investors to invest in physical gold. It bears emphasizing that a gold IRA only becomes necessary when an. Looking to acquire precious metals within an IRA or for Direct Delivery? Advantage Gold provides in-depth education with the highest level of customer. Though IRAs were once limited to holding American Eagle gold and silver coins, today, IRAs can invest in IRS-permitted gold, silver, palladium and platinum. Explore the tax benefits, ease of management & diversification potential of a Gold IRA versus the flexibility and tangible ownership of owning physical gold.

Best Home Loan Lenders For Self Employed

Fortunately, that's only for traditional home loan financing. Self-employed borrowers like yourself an unconventional loan. In other words, these are loans that. Our team is well versed in these loans and placing the borrowers where they can get the optimal loan to fit their needs. For investment properties, please. Find the right mortgage that fits your business income. We have the lending answers for you, and the better rates to go with it. What do mortgage lenders require to approve a loan for a self-employed person? . Income stability (for two years or more). Are you searching for the best self-employed mortgage programs? We have decades of experience in designing custom loan programs for Self-Employed. Here's a breakdown of the six best mortgage loans available for self-employed borrowers in Houston. Best For Self-employed Mortgage Applicants. Equitable Bank. Equitable Bank. Our ratings take into account a product's rewards, fees, rates and other. 3. USDA Loan If you're self-employed and have always dreamed of living in the country or a relatively rural area, a USDA loan might be the mortgage that works. Our mortgage for self-employed workers is designed with you in mind, so you can finance or refinance your dream home. Fortunately, that's only for traditional home loan financing. Self-employed borrowers like yourself an unconventional loan. In other words, these are loans that. Our team is well versed in these loans and placing the borrowers where they can get the optimal loan to fit their needs. For investment properties, please. Find the right mortgage that fits your business income. We have the lending answers for you, and the better rates to go with it. What do mortgage lenders require to approve a loan for a self-employed person? . Income stability (for two years or more). Are you searching for the best self-employed mortgage programs? We have decades of experience in designing custom loan programs for Self-Employed. Here's a breakdown of the six best mortgage loans available for self-employed borrowers in Houston. Best For Self-employed Mortgage Applicants. Equitable Bank. Equitable Bank. Our ratings take into account a product's rewards, fees, rates and other. 3. USDA Loan If you're self-employed and have always dreamed of living in the country or a relatively rural area, a USDA loan might be the mortgage that works. Our mortgage for self-employed workers is designed with you in mind, so you can finance or refinance your dream home.

Where to Get Private Mortgage Loans for Self-Employed Individuals. You can get a self-employed mortgage through Angel Oak Mortgage Solutions, a full-service. Great option for self-employed borrowers. Use statement instead of tax documents. A home loan solution for self-employed borrowers. A income loan is. For the self employed borrowers looking to purchase the most common way to get you approved is to use your bank statements over the last only 1 (our closest. Dream Home Mortgage have Creative solutions for self employed · Lowest interest rates. · We offer loans to borrower with ITIN # and No credit score. · We still. These lenders consist of the six largest banks in Canada: CIBC, RBC, TD, Scotiabank, BMO and National Bank. They will generally have the most strict lending. Self-employed home loans are mortgages offered to individuals who own their own business and do not have proof of employment-based income. Bank statement loans in Texas provide an alternative route to home financing for business owners and self-employed individuals in the Lone Star State. Self-Employed borrowers can qualify for the same loan programs as traditional borrowers, including Conventional, FHA, USDA, and VA Loans. Lenders who are. Best for all credit types. Avant. ; Best for low origination fees. Axos. ; Best for high close rates if pre-approved. Best Egg. 4 ; Best for no origination. Self-Employed Mortgage, Business Owner Mortgage, Self-Employed Loans, Business Owner Loans, Bank Statement Mortgage, Bank Statement Loans. Everything you need to know about getting a self-employed mortgage in Canada, the qualifications required and options to explore at newbalance996discount.site Welcome to First National Bank of America, where Non-QM mortgages are tailored to self-employed individuals and independent contractors. We understand the. What Is the Best Mortgage for Self-Employed People? There is no “best” mortgage for self-employed people. Every home loan applicant must determine the best. If you're self-employed as a business owner, contractor, freelancer, or gig worker, qualifying for a mortgage no longer has to be just a dream. home mortgage loan is income. Lenders, both large and small, justifiably best way to approach qualifying for a self-employed mortgage loan. The. Want to see if anyone has good experiences and recommendations, trying to widen my offerings as a loan officer. best way to approach qualifying for a self-employed mortgage loan. The top 1% of NH Loan Officers by leading national lender United Wholesale Mortgage. "The requirements are a little more stringent with more documentation as lenders and banks want borrowers to demonstrate "income stability", says Richard Liu, a. Shop around and compare lenders: Research and compare as many personal loan lenders as possible to find the right loan for you. · Choose your loan option: After. Research Lenders that Specialize in Self-Employed Mortgages: Look for lenders who offer products like bank statement loans or non-QM loans, as they are more.

What Is An Llc Vs Sole Proprietorship

Someone might choose an LLC over a sole proprietorship because an LLC provides limited liability protection, separates personal and business assets, and can. LLC vs Sole Proprietorship To start, the main distinction between an LLC and SP is that an LLC offers the business owner personal liability protection and a. A sole proprietorship is a one-person business owned by an individual who also handles the operation of the business. A limited liability corporation, better known as an LLC, is a business structure that combines pass-through taxation (like in a partnership or sole. In general, an LLC offers clearer business protection from you the person when it comes to litigation. Anybody can sue anyone for anything at. Sole proprietorships are easy to set up, but LLCs offer liability protection by separating your business and personal assets. Each business structure has. A sole proprietor is a person who sells something without first registering with the state. An LLC, on the other hand, is a business entity formed by filing. A single member LLC in Texas will provide the benefits of financial separation and asset protection between your personal and business assets in most cases. The largest difference between an LLC and a sole proprietorship is the liability and legal protection awarded with an LLC. If you form as a sole proprietor then. Someone might choose an LLC over a sole proprietorship because an LLC provides limited liability protection, separates personal and business assets, and can. LLC vs Sole Proprietorship To start, the main distinction between an LLC and SP is that an LLC offers the business owner personal liability protection and a. A sole proprietorship is a one-person business owned by an individual who also handles the operation of the business. A limited liability corporation, better known as an LLC, is a business structure that combines pass-through taxation (like in a partnership or sole. In general, an LLC offers clearer business protection from you the person when it comes to litigation. Anybody can sue anyone for anything at. Sole proprietorships are easy to set up, but LLCs offer liability protection by separating your business and personal assets. Each business structure has. A sole proprietor is a person who sells something without first registering with the state. An LLC, on the other hand, is a business entity formed by filing. A single member LLC in Texas will provide the benefits of financial separation and asset protection between your personal and business assets in most cases. The largest difference between an LLC and a sole proprietorship is the liability and legal protection awarded with an LLC. If you form as a sole proprietor then.

There are many differences between sole proprietorships, limited liability companies, and other business entities. By default, LLCs with a single member are treated as a sole proprietorship, and multiple members are treated as a partnership. They have a pass-through income. While similar in nature, there are key differences between a single-member LLC and a sole proprietorship from tax structuring, legal protections and more. Although sole proprietorship is easier to start and operate, LLC is a separate entity and offers protection in terms of liabilities. It is simple to form a sole proprietorship. You do not need to register, and it is easier to manage and file taxes. However, your personal assets are not. This guide compares the differences between sole proprietorships and LLCs to help you decide which business type is right for you as a new business owner. An important downside of a sole proprietorship is that it provides no liability protection to the owner. By contrast, an LLC separates business and personal. This article delves into the essentials of what an LLC is, the advantages of forming one, and contrasts these with the straightforward, less formal nature of a. Review common business structures · Sole proprietorship · Partnership · Limited liability company (LLC) · Corporation · Cooperative. Key Differences Between Sole Proprietorship and an LLC ; Management ; The sole owner manages the business and makes all decisions. LLC Advantages Over Sole Proprietorship. Whether you decide to register your business as a sole proprietorship or an LLC will vary depending on your personal. By default, a single-member LLC is considered a disregarded entity. Therefore, as with a sole proprietorship, business tax obligations flow through to the LLC. As a sole proprietor, you'll be paying both the employer and employee's share. In terms of taxes, an LLC lies somewhere between an independent contractor and a. A limited liability company or LLC is a type of business entity that's registered with the state, offers entrepreneurs limited liability protection, and. The main difference between an LLC and a sole proprietorship is liability protection. An LLC is a separate legal entity from its owner(s). An LLC is not a separate tax entity like a corporation but it can make an election to be taxed as a corporation. If such an election is not made, it is taxed as. Additionally, a single-member LLC has a clear ownership as stated in the articles of organization, which makes it easy to sell or transfer the business in the. A sole proprietorship is the easiest and most basic form by which a business can be run and is subsequently not considered to be a legal entity. What is the difference between a business being sole proprietor and a Limited Liability Company (LLC)? · Easiest and least expensive form of ownership to. A limited liability corporation also called a limited liability company, or LLC, is a business structure in which the owner, or owners, are a separate legal.

Apps That Borrow You Money

Compare the Best Cash Advance Apps ; Loan app, Loan Amounts ; Varo Best Overall, Best for Fast Funding With a Low Fee, $20 to $ ; Payactiv Runner-Up Best. SoLo is a community finance platform where our members step up for one another. Borrow, lend and bank on your terms and no mandatory fees. Meet FloatMe, your Best Financial Friend designed to help you get, manage, and save money. Get fast cash advances directly to your bank account and more by. While Brigit offers free financial advice and alerts, you'll have to fork over $ a month to access the quick cash feature. Brigit can also assist you in. Meet FloatMe, your Best Financial Friend designed to help you get, manage, and save money. Get fast cash advances directly to your bank account and more by. An Online Platform to Loan Money Worldwide · How Does Pigeon Work? · Getting Started Is Easy · Simple Loans Between Family, Friends, and People You Trust · Ready To. 7 Loan Apps to Consider · Chime. · Dave. · Brigit. · Albert. · EarnIn. · MoneyLion. · Possible Finance. Chime: Best For No. Dave. Dave is a cash advance app that works best for people who aren't living paycheck to paycheck. The required Dave Extra Cash Account is a. Get fast cash advances directly to your bank account and more by becoming a member. No credit checks. No interest. No request for tips ever. No problem. Compare the Best Cash Advance Apps ; Loan app, Loan Amounts ; Varo Best Overall, Best for Fast Funding With a Low Fee, $20 to $ ; Payactiv Runner-Up Best. SoLo is a community finance platform where our members step up for one another. Borrow, lend and bank on your terms and no mandatory fees. Meet FloatMe, your Best Financial Friend designed to help you get, manage, and save money. Get fast cash advances directly to your bank account and more by. While Brigit offers free financial advice and alerts, you'll have to fork over $ a month to access the quick cash feature. Brigit can also assist you in. Meet FloatMe, your Best Financial Friend designed to help you get, manage, and save money. Get fast cash advances directly to your bank account and more by. An Online Platform to Loan Money Worldwide · How Does Pigeon Work? · Getting Started Is Easy · Simple Loans Between Family, Friends, and People You Trust · Ready To. 7 Loan Apps to Consider · Chime. · Dave. · Brigit. · Albert. · EarnIn. · MoneyLion. · Possible Finance. Chime: Best For No. Dave. Dave is a cash advance app that works best for people who aren't living paycheck to paycheck. The required Dave Extra Cash Account is a. Get fast cash advances directly to your bank account and more by becoming a member. No credit checks. No interest. No request for tips ever. No problem.

8 Cash Advance Apps to Cover You Till Payday · Brigit: Best for financial management · Empower: Best for small loan amounts · EarnIn: Best for large cash advances. Another online banking app that offers a combination of early cash advances and early paycheck access is MoneyLion. Its Instacash feature lets you borrow up to. Get a Personal Loan offer up to $, Cash Advance up to $, and more. MoneyLion, a leading financial tech co., is your trusted source for making. Cash App Borrow is a feature that allows eligible users to take out short-term loans directly through the app To borrow money from Cash App, open the app, tap. Need $ or more? Now you can get personal loan offers from Brigit partners in the Earn & Save section on the app. - No one likes bugs, we fixed 'em! Get an Instant Cash advance, build credit, save money, and track your spending – all on Brigit. Join over 8 million users on the financial health & budgeting. Spotloan is a better way to borrow extra money. It's not a payday loan. It's an installment loan, which means you pay down the balance with each on-time. Klover is a budgeting and cash advance app lets you borrow up to $ against upcoming paychecks. And I like Klover since it doesn't have any mandetory fees. A copy of the Cash App Terms of Service, and related policies, can be found here. Dave is a cash advance app that allows you to borrow money after opening an ExtraCash account with them. These small loans can be used to make sure you have. Brigit, Albert, Dave, Kleo, Klover, Empower, and possible are good apps for emergency cash spotting. Brigit: Brigit is an app that offers cash advances of up to $ with no interest or fees. It also provides budgeting tools and features to help. Gerald offers more features than other cash advance apps, gives you more options for how you get your money and makes it easy to pay back without fees or. Like Moneylion, Brigit is a well-known app that lets users borrow money while building their credit. If you need some additional cash to support these apps. Advance the money you need with no credit check or late fees. It takes only minutes to download the Dave app, securely link your bank, and send the money to. A paycheck advance app allows you to use your smartphone to borrow money in between paychecks. Instead of running a credit check, the app will review your bank. The availability of apps like PayDaySay, Dave, Chime, MoneyLion, and Brigit has revolutionized how individuals access instant cash assistance. Open Cash App. · On the Home screen, scroll down and select "Borrow." You can borrow between $20 and $ · Enter the amount you need. · Choose a repayment plan. The Dave app has millions of mobile application downloads from consumers who want to set up an online bank account and apply for short-term cash advance loans. The Dave Cash app is a mobile application that assists you in managing your money and avoiding overdraft fees. It offers a secure and.

Business License To Sell Online

A business tax account and filing are not required with a minimum activity license. A business will renew directly with their local county clerk's office. Get business licenses and business permits online through LegalZoom Do I need a business license to sell online? Do you need a business license. How to apply · Start a scenario using the Business Licensing Wizard. · Apply online applications will take approximately 10 business days to process. · By mail. W-2 Transmitter Registration. Employers may electronically register and obtain their user ID (ETIN) and password for transmission of W-2s online. idot pilot. Transaction Privilege (Sales) Tax (TPT) License - If you plan to sell a Online Lodging Marketplace; Personal Property Rental; Pipeline; Private. Any company involved in wholesale, retail sales, or any activity involving taxable goods and services must apply for a seller's permit. This license is similar. Online-only businesses generally do not require a specific state license unless you are selling a regulated product or service. Therefore, business owners. online businesses can be home-based businesses. Try our online application form. By applying online, you'll be able to: Provide the required details at the. You must obtain a seller's permit if you: Are engaged in business in California; Intend to sell or lease tangible personal property that would ordinarily be. A business tax account and filing are not required with a minimum activity license. A business will renew directly with their local county clerk's office. Get business licenses and business permits online through LegalZoom Do I need a business license to sell online? Do you need a business license. How to apply · Start a scenario using the Business Licensing Wizard. · Apply online applications will take approximately 10 business days to process. · By mail. W-2 Transmitter Registration. Employers may electronically register and obtain their user ID (ETIN) and password for transmission of W-2s online. idot pilot. Transaction Privilege (Sales) Tax (TPT) License - If you plan to sell a Online Lodging Marketplace; Personal Property Rental; Pipeline; Private. Any company involved in wholesale, retail sales, or any activity involving taxable goods and services must apply for a seller's permit. This license is similar. Online-only businesses generally do not require a specific state license unless you are selling a regulated product or service. Therefore, business owners. online businesses can be home-based businesses. Try our online application form. By applying online, you'll be able to: Provide the required details at the. You must obtain a seller's permit if you: Are engaged in business in California; Intend to sell or lease tangible personal property that would ordinarily be.

The easiest way to submit your Business License Application or make changes to your existing Business License is online. Yarrow Farm Market. Yarrow. Business name registrations or renewals can be done in-person or online through the Ontario Business Registry. Guidance on registration is available virtually. This page provides licensing information for selling goods or services taxed under: Apply for a license with the Business Tax Application. No, you won't need to have a business license in every state you sell to; but, you may need to collect sales tax in some states that require it. A business license is required for most businesses, including retailers and wholesalers. A trader's license is required for buying and re-selling goods. And. As part of making your business legally compliant, you'll need to name your business and establish it as a legal entity. For most people selling online, it. by mail: City Hall, Attn: Business Licence Clerk, 1 Centennial Square, Victoria, BC, V8W 1P8. Some applications may be completed and submitted online, others. No, you won't need to have a business license in every state you sell to; but, you may need to collect sales tax in some states that require it. Any business, including home-based businesses, must obtain a local city or county business license. This is a basic license that allows the holder to engage in. Apply for a Family Home Centre Licence · Early Years Centre Designation · Apply to Modify Early Learning and Child Care Licence Online Selling Tobacco and. Do you need a business license to sell online? · Licenses specific to home-based businesses · Zoning restrictions and variances · General business license and. Who must obtain a seller's permit?, You must obtain a seller's permit if you: Are engaged in business in California and Intend to sell or lease tangible. You'll only need licenses from your city and state of operation where your business is based. This is different from collecting eCommerce sales tax. Who must obtain a seller's permit?, You must obtain a seller's permit if you: Are engaged in business in California and Intend to sell or lease tangible. As part of making your business legally compliant, you'll need to name your business and establish it as a legal entity. For most people selling online, it. Any company involved in wholesale, retail sales, or any activity involving taxable goods and services must apply for a seller's permit. This license is similar. Depending on your location and the products or services you offer, you may need specific licenses and permits to operate legally. Consult with local authorities. The short answer to that question in the USA is: “If you want to operate as a legitimate business – yes.” The long answer is in the rest of this blog post. To start your home-based business you will need a development permit and business licence. You can apply for both at the same time using the home-based. Learn about licensing requirements, fees, timelines, permits and approvals you need to open your business. Businesses that do not need a municipal licence.

How Much Is Candle Making Insurance

General liability insurance covers the risks that affect almost every candle maker. It's the most common insurance for small businesses and entrepreneurs, and. Public liability insurance can help to provide protection for your candle shop from claims made by members of the public. This may include paying compensation. The cost of insurance for candle makers depends on several factors, including coverage needs and business size. For example, a candlemaker with no employees. Once you join the Indie Business Network as an ENTREPRENEUR MEMBER, you will receive instructions and a link via email to purchase insurance coverage. Note: The first $ of insurance is free. For additional insurance round up to nearest $ ie $ order purchase $ Public liability insurance is the most common cover type for candle making and wax melt businesses due to the protection it offers against claims made by third. Insureon helps you find the right candle maker insurance for your unique risks. Get free quotes from top-rated insurance providers and advice from a licensed. How Much Does Candle Makers Insurance Cost? Basic candle makers insurance starts at $ per year for a CGL policy with a $1 million coverage limit. But we. The cost of event insurance for candle makers starts at $49 for 1–3 days of consecutive coverage with ACT Go. We also offer longer policy lengths for an. General liability insurance covers the risks that affect almost every candle maker. It's the most common insurance for small businesses and entrepreneurs, and. Public liability insurance can help to provide protection for your candle shop from claims made by members of the public. This may include paying compensation. The cost of insurance for candle makers depends on several factors, including coverage needs and business size. For example, a candlemaker with no employees. Once you join the Indie Business Network as an ENTREPRENEUR MEMBER, you will receive instructions and a link via email to purchase insurance coverage. Note: The first $ of insurance is free. For additional insurance round up to nearest $ ie $ order purchase $ Public liability insurance is the most common cover type for candle making and wax melt businesses due to the protection it offers against claims made by third. Insureon helps you find the right candle maker insurance for your unique risks. Get free quotes from top-rated insurance providers and advice from a licensed. How Much Does Candle Makers Insurance Cost? Basic candle makers insurance starts at $ per year for a CGL policy with a $1 million coverage limit. But we. The cost of event insurance for candle makers starts at $49 for 1–3 days of consecutive coverage with ACT Go. We also offer longer policy lengths for an.

Types of business insurance for candle makers · General liability insurance · Product liability insurance · Business property insurance · Business interruption. costs or property damage if your product has caused a loss. Do I need a company name in place? Many people who run a small part time business do have a. costs or property damage if your product has caused a loss. Do I need a company name in place? Many people who run a small part time business do have a. My question is how many candles of each scent should I make to start. Is it If you are looking to purchase insurance for your candle business, it may be worth. There are two policy limits available for Thimble's Liability Insurance for Candlemakers: $1 million and $2 million. The policy you choose should reflect the. Once you join the Indie Business Network as an ENTREPRENEUR MEMBER, you will receive instructions and a link via email to purchase insurance coverage. Note: The first $ of insurance is free. For additional insurance round up to nearest $ ie $ order purchase $ Expect to pay $63 per month or $ per year for a $1 million general liability insurance. Keep in mind that your own candle makers insurance rates may cost. How Much Does Candle Makers Insurance Cost? Basic candle makers insurance starts at $ per year for a CGL policy with a $1 million coverage limit. But we. How much can you make from selling candles? New candle makers can What can you do with candle wax other than making candles? 2, Customisable cover for your candle or wax melt business. Choose from covers including public and product liability, business equipment and cyber insurance. The starting price for insurance for candle makers typically starts at $ for Commercial General Liability with a $1M coverage limit. We want to make sure you. Soap and Candle Maker Policy Prices ; 3 Month Cover. from $ ; 6 Month Cover. from $ ; Annual Cover · from $ The pricing varies based on what you're making and selling, and how much liability coverage you want. They don't cover candle makers of any type. Soap. It's highly unlikely you would be insured under your home insurance policy. So, if you are making and/or selling candles, wax melts, or other crafts from your. General liability insurance A general liability policy covers financial losses from customer lawsuits, such as an allergic reaction to an essential oil in a. Candle maker insurance is there to protect you against unexpected financial losses that you might suffer when making and selling your products. There are many. once you have a good candle with a great scent throw and even melt, then you want to line up some insurance, your business license, sellers. Product Liability Insurance for candle makers, is required for crafts you produce that may accidentally cause damage to a customer (or 3rd party using your. For less than $ a year, enjoy all the benefits of HSCG membership, including an insurance premium that protects you and your growing business.